What You Should Know About Receipts and Record Keeping for Your Business

marketing

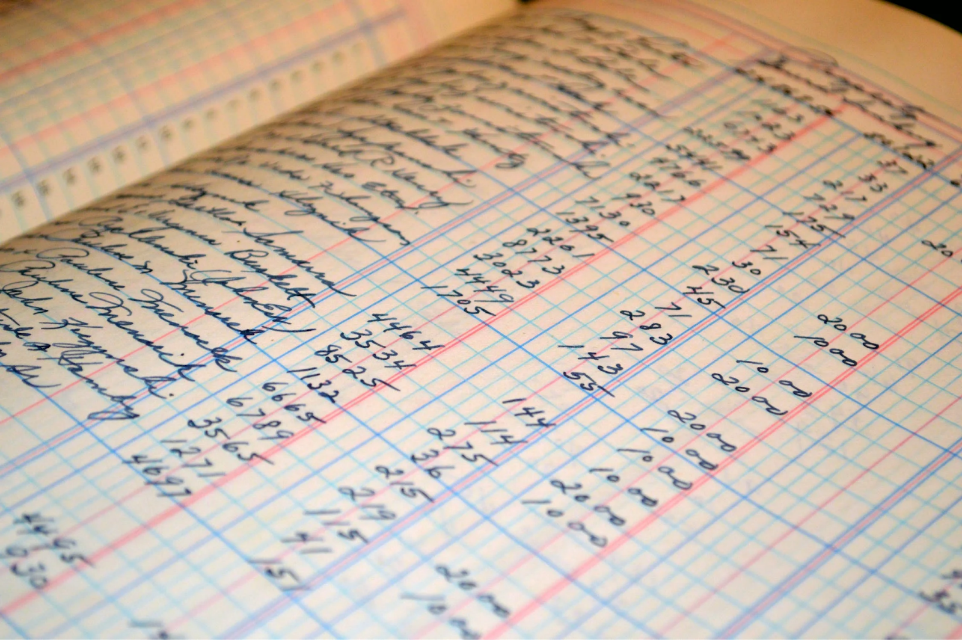

While it might seem tedious, the truth is that you’re required by law to keep accurate business records of your income and expenses. The good news is that the government doesn’t hold you to any specific record keeping processes, as long as you maintain one. This is why, as professional tax accountants, we’ll dive into the dos and don’ts of record keeping for businesses in Canada to help you keep accurate records so that you can get back to what matters most: running your business.

Types of Record Keeping You Need to Know

First and foremost, what kind of records do you need to keep? There are three categories:

The Dos and Don’ts of Record Keeping

Running a business is complex, but we can make it easier with these simple dos and don’ts of record keeping for businesses in Canada.

Do: Keep your supporting documentation for six years

Filing your taxes isn’t necessarily the end of the line. You’re required to keep supporting documentation for six years after the end of the tax year they relate to, in case you’re asked for them by the CRA. Six years of business income and expenses documentation can add up, so maintaining an organized, easy-to-use filing system is key. Need help figuring out a system? We’re here for you.

Don’t: Mix your business and personal expenses

While it might seem convenient to dump all of your receipts into one folder/box and sort it out come tax season, you're going to end up spending a ton of time sorting and figuring out which is which. By keeping everything separate from the get-go, you’ll make your life much easier. Take it a step further and maintain separate bank accounts and cards for your business versus personal, which means your business bank account will always be an accurate reflection of your business records.

Do: Save receipts

Your bank statements won’t count when it comes to explaining a business purchase that you’re deducting. You’ll need an itemized receipt, either digital or paper, that corresponds with the transaction. Unsure if you can deduct an expense? Keep the receipt to be safe and check with your accountant later.

Don’t: Fall behind

We get it: as a business owner, there’s no shortage of things to do every day. But staying up to date on your record keeping should be a priority; after all, the financial success of your business depends on it. You should be reviewing and updating your records on a weekly basis at the very least. Falling behind on this can escalate quickly and turn a small task into a mountain of a problem.

Do: Use an accountant

While individuals can file their taxes fairly easily these days without the help of an accountant, a business should always get professional help. Not only does an accountant help you ensure you’re filing your taxes correctly while maintaining the correct supporting documentation, but they can also prevent you from leaving money on the table. An accountant ensures you’re taking advantage of all possible deductions and credits, to give your business as much of a leg up as possible.

The Dos and Don’ts of Record Keeping

Running a business is complex, but we can make it easier with these simple dos and don’ts of record keeping for businesses in Canada.

Do: Keep your supporting documentation for six years

Filing your taxes isn’t necessarily the end of the line. You’re required to keep supporting documentation for six years after the end of the tax year they relate to, in case you’re asked for them by the CRA. Six years of business income and expenses documentation can add up, so maintaining an organized, easy-to-use filing system is key. Need help figuring out a system? We’re here for you.

Don’t: Mix your business and personal expenses

While it might seem convenient to dump all of your receipts into one folder/box and sort it out come tax season, you're going to end up spending a ton of time sorting and figuring out which is which. By keeping everything separate from the get-go, you’ll make your life much easier. Take it a step further and maintain separate bank accounts and cards for your business versus personal, which means your business bank account will always be an accurate reflection of your business records.

Do: Save receipts

Your bank statements won’t count when it comes to explaining a business purchase that you’re deducting. You’ll need an itemized receipt, either digital or paper, that corresponds with the transaction. Unsure if you can deduct an expense? Keep the receipt to be safe and check with your accountant later.

Don’t: Fall behind

We get it: as a business owner, there’s no shortage of things to do every day. But staying up to date on your record keeping should be a priority; after all, the financial success of your business depends on it. You should be reviewing and updating your records on a weekly basis at the very least. Falling behind on this can escalate quickly and turn a small task into a mountain of a problem.

Do: Use an accountant

While individuals can file their taxes fairly easily these days without the help of an accountant, a business should always get professional help. Not only does an accountant help you ensure you’re filing your taxes correctly while maintaining the correct supporting documentation, but they can also prevent you from leaving money on the table. An accountant ensures you’re taking advantage of all possible deductions and credits, to give your business as much of a leg up as possible.

The Bottom Line

Accurate record keeping might be time consuming, but it’s important for your business. After all, not only does it make tax season easier on you, but it also helps you maintain an accurate picture of your business’ financial health.

Maintaining accurate records is required by law, and not doing so could lead to you being required to pay additional taxes, interest and penalties. These tips and tricks help you avoid the common pitfalls of record keeping while optimizing your habits to make tax season and potential audits easier on you.

The Bottom Line

Accurate record keeping might be time consuming, but it’s important for your business. After all, not only does it make tax season easier on you, but it also helps you maintain an accurate picture of your business’ financial health.

Maintaining accurate records is required by law, and not doing so could lead to you being required to pay additional taxes, interest and penalties. These tips and tricks help you avoid the common pitfalls of record keeping while optimizing your habits to make tax season and potential audits easier on you.

- Income

- Expenses

- Property

The Dos and Don’ts of Record Keeping

Running a business is complex, but we can make it easier with these simple dos and don’ts of record keeping for businesses in Canada.

Do: Keep your supporting documentation for six years

Filing your taxes isn’t necessarily the end of the line. You’re required to keep supporting documentation for six years after the end of the tax year they relate to, in case you’re asked for them by the CRA. Six years of business income and expenses documentation can add up, so maintaining an organized, easy-to-use filing system is key. Need help figuring out a system? We’re here for you.

Don’t: Mix your business and personal expenses

While it might seem convenient to dump all of your receipts into one folder/box and sort it out come tax season, you're going to end up spending a ton of time sorting and figuring out which is which. By keeping everything separate from the get-go, you’ll make your life much easier. Take it a step further and maintain separate bank accounts and cards for your business versus personal, which means your business bank account will always be an accurate reflection of your business records.

Do: Save receipts

Your bank statements won’t count when it comes to explaining a business purchase that you’re deducting. You’ll need an itemized receipt, either digital or paper, that corresponds with the transaction. Unsure if you can deduct an expense? Keep the receipt to be safe and check with your accountant later.

Don’t: Fall behind

We get it: as a business owner, there’s no shortage of things to do every day. But staying up to date on your record keeping should be a priority; after all, the financial success of your business depends on it. You should be reviewing and updating your records on a weekly basis at the very least. Falling behind on this can escalate quickly and turn a small task into a mountain of a problem.

Do: Use an accountant

While individuals can file their taxes fairly easily these days without the help of an accountant, a business should always get professional help. Not only does an accountant help you ensure you’re filing your taxes correctly while maintaining the correct supporting documentation, but they can also prevent you from leaving money on the table. An accountant ensures you’re taking advantage of all possible deductions and credits, to give your business as much of a leg up as possible.

The Dos and Don’ts of Record Keeping

Running a business is complex, but we can make it easier with these simple dos and don’ts of record keeping for businesses in Canada.

Do: Keep your supporting documentation for six years

Filing your taxes isn’t necessarily the end of the line. You’re required to keep supporting documentation for six years after the end of the tax year they relate to, in case you’re asked for them by the CRA. Six years of business income and expenses documentation can add up, so maintaining an organized, easy-to-use filing system is key. Need help figuring out a system? We’re here for you.

Don’t: Mix your business and personal expenses

While it might seem convenient to dump all of your receipts into one folder/box and sort it out come tax season, you're going to end up spending a ton of time sorting and figuring out which is which. By keeping everything separate from the get-go, you’ll make your life much easier. Take it a step further and maintain separate bank accounts and cards for your business versus personal, which means your business bank account will always be an accurate reflection of your business records.

Do: Save receipts

Your bank statements won’t count when it comes to explaining a business purchase that you’re deducting. You’ll need an itemized receipt, either digital or paper, that corresponds with the transaction. Unsure if you can deduct an expense? Keep the receipt to be safe and check with your accountant later.

Don’t: Fall behind

We get it: as a business owner, there’s no shortage of things to do every day. But staying up to date on your record keeping should be a priority; after all, the financial success of your business depends on it. You should be reviewing and updating your records on a weekly basis at the very least. Falling behind on this can escalate quickly and turn a small task into a mountain of a problem.

Do: Use an accountant

While individuals can file their taxes fairly easily these days without the help of an accountant, a business should always get professional help. Not only does an accountant help you ensure you’re filing your taxes correctly while maintaining the correct supporting documentation, but they can also prevent you from leaving money on the table. An accountant ensures you’re taking advantage of all possible deductions and credits, to give your business as much of a leg up as possible.

The Bottom Line

Accurate record keeping might be time consuming, but it’s important for your business. After all, not only does it make tax season easier on you, but it also helps you maintain an accurate picture of your business’ financial health.

Maintaining accurate records is required by law, and not doing so could lead to you being required to pay additional taxes, interest and penalties. These tips and tricks help you avoid the common pitfalls of record keeping while optimizing your habits to make tax season and potential audits easier on you.

The Bottom Line

Accurate record keeping might be time consuming, but it’s important for your business. After all, not only does it make tax season easier on you, but it also helps you maintain an accurate picture of your business’ financial health.

Maintaining accurate records is required by law, and not doing so could lead to you being required to pay additional taxes, interest and penalties. These tips and tricks help you avoid the common pitfalls of record keeping while optimizing your habits to make tax season and potential audits easier on you.